At present, the global chip market is dominated by the U.S., Japanese and European companies, and the high-end market is almost monopolized by these three major regions. In the field of high-end chips, domestic manufacturers have not yet formed in scale, so manufacturing industry is still dominated by original equipment manufacturer (OEM). In terms of geographical distribution, the Asia-Pacific region accounts for half of the global semiconductor market. According to the data, in 2018, the sales volume of China's semiconductor chip market reached 194.2 billion US dollars, with a year-on-year growth of 16.89%, ranking the first place. At the meantime, the market size of North America was 56.7 billion, with a year-on-year growth of 15.86%, ranking the second place. Despite China's chip market is the largest and fastest growing market in the world, it still heavily depends on foreign countries.

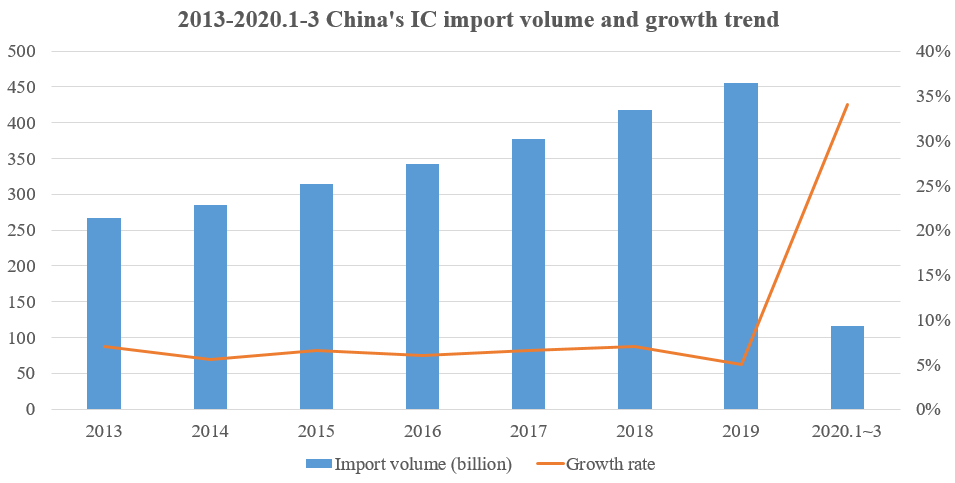

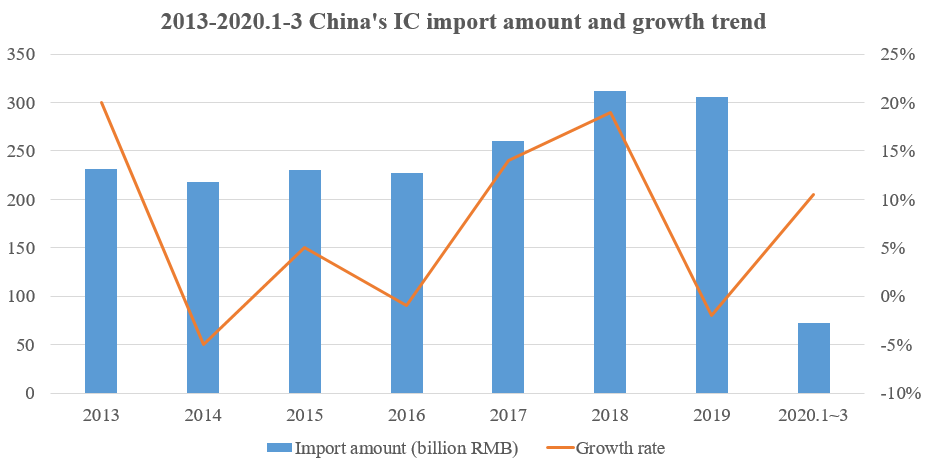

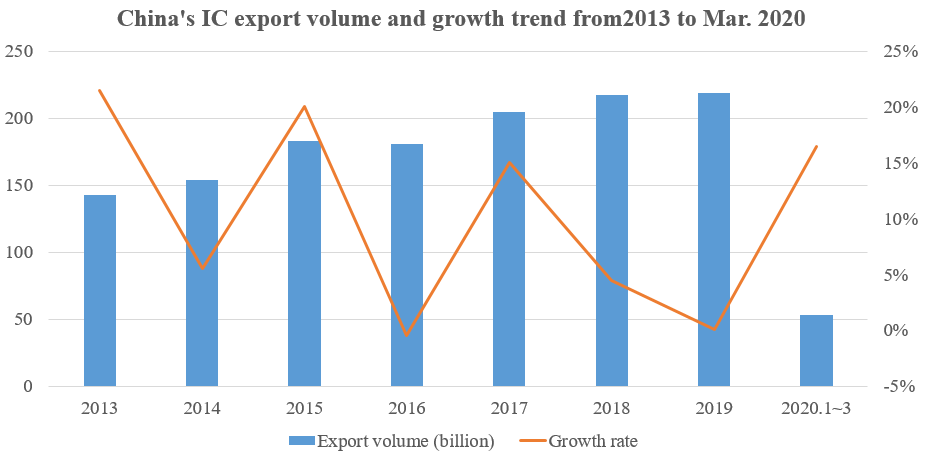

In 2018, China imported about 417.569 billion ICs (chips), including 166.9 billion semiconductor IC chips, with a year-on-year increase of 15.65%, making China the world's largest chip importer. Meanwhile, China exported 217.1 billion semiconductor chips, including 15.7 billion semiconductor IC chips, with a year-on-year increase of 25%

[1]. China is also an important chip exporter in the world. But at the same time, it is also clear that China's total exports of chips slightly exceed 50% of the total imports, but the export earnings are only slightly more than a quarter of the import value.

China is a global electronic manufacturing base with the most perfect industrial chain and huge consumer market. After the trade issues of Huawei and ZTE, it could be expected that there will be more policy support for IC industry. As the domestic semiconductor industry enters the intensive construction period and domestic enterprises increase research and development driven by national policies and market demand, China is expected to speed up the localization of ICs and gradually realize the substitution from low-end to high-end, and thus reduce the import of ICs and the dependence on other countries.

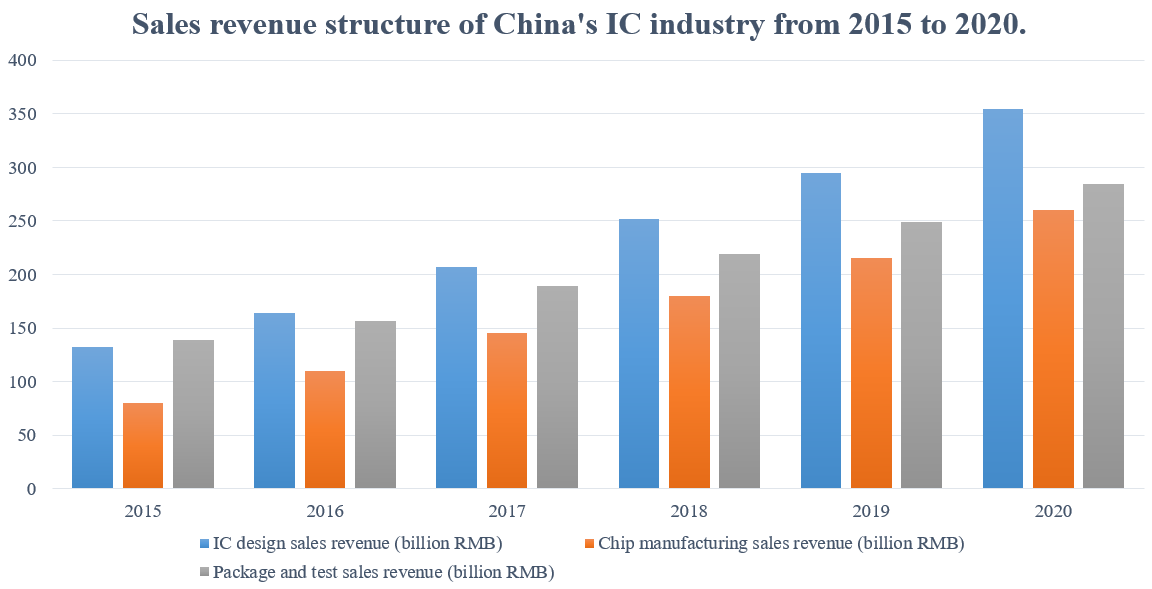

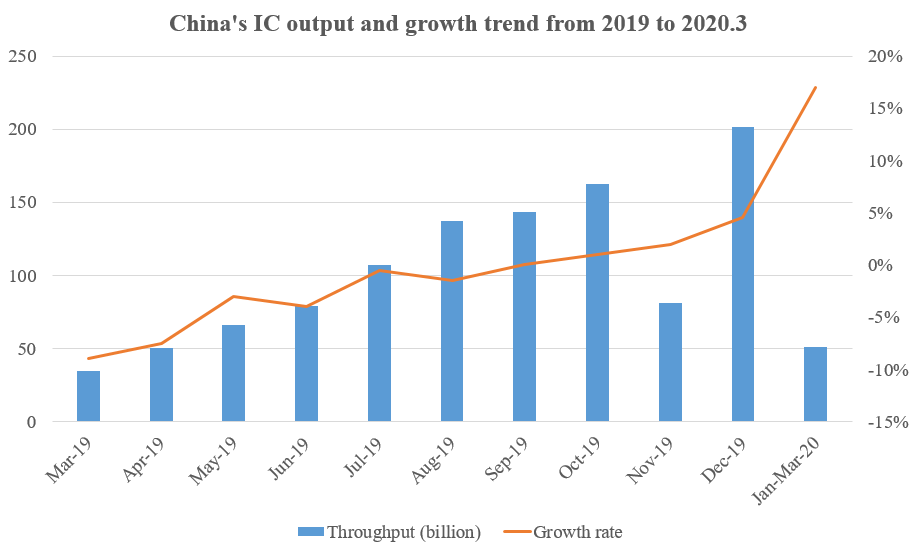

In recent years, driven by the national policy and market application, China’s IC industry has maintained a rapid growth and continues to maintain the global leading position of growth rate. In the first half of 2019, the sales volume of China's IC industry was 304.82 billion RMB

[2], with a year-on-year increase of 11.8%. According to analysis of institutions, with the continuous deepening of China's industrialization and informatization, the rising information consumption and the acceleration of smart city construction, and with the gradual development of cloud computing, big data, Internet of Things (IoT) and other fields, it is expected that the China’s IC market will maintain a stable growth in the next three years. It also pointed out that in the next few years, China's IC industry will present the following trends

[2-5].