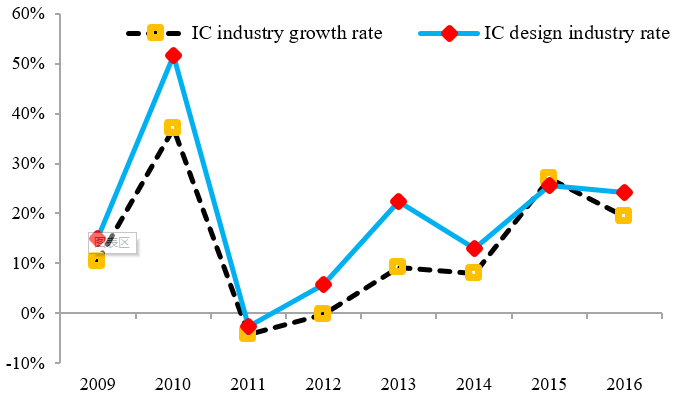

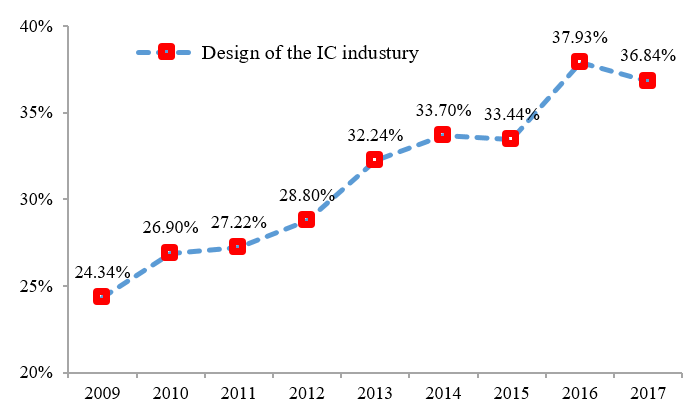

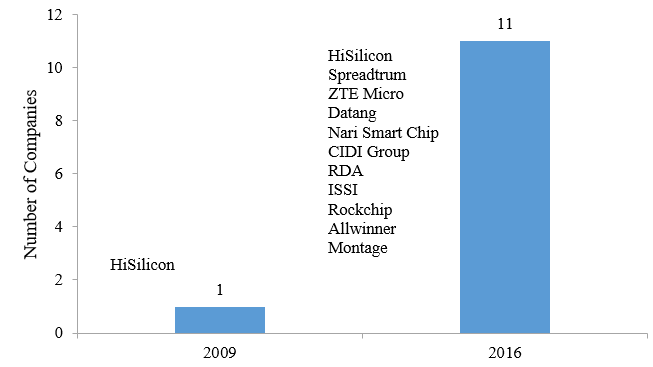

China's IC design industry has experienced rapid expansion not only in the domestic market but also in the global mainstream competitive landscape. In 2014 HiSilicon, UNIS and Datang entered the world's top 25 IC design company list, in 2015 China took nine seats in the top 50 fabless companies, and in 2016 this number rose to 11 as shown in Figure 4. Comparing to the year 2009 in which only HiSilicon was in the top list, China's IC design industry has largely grown.

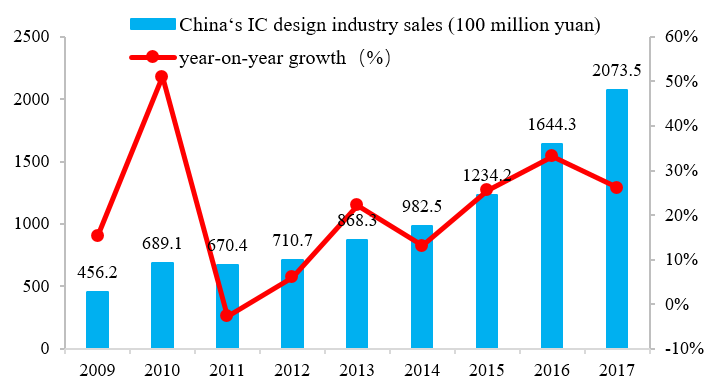

In 2017 the domestic IC design industry revenue has reached 207.35 billion yuan, an annual increase of 26.1%. Among China’s top ten IC design companies, Huawei's HiSilicon ranked the first for its 36.1 billion yuan revenue, Spreadtrum ranked second with 11 billion yuan and ZTE ranked third with 7.6 billion yuan. The threshold level for the top ten domestic IC design company revenue list is 2.05 billion yuan.

Table 3.

2017 China's IC design industry's top ten company ranking. | Ranking | Company Name | Sales (million RMB) |

| 1 | HiSilicon | 361 |

| 2 | UNIS Spreadtrum | 110 |

| 3 | ZTE Microelectronics | 76 |

| 4 | Huada Semiconductor | 52.1 |

| 5 | IPCore Microelectronics | 44.9 |

| 6 | Goodix | 38.9 |

| 7 | Hangzhou Silan | 31.8 |

| 8 | Focaltech | 28 |

| 9 | Galaxycore | 25.2 |

| 10 | Vimicro | 20.5 |

Currently the mainstream of China domestic design industry employs the 90nm ‒ 28nm node technology while some has begun using the advanced 16/14nm process. Shanghai is among the leading domestic IC design industry regions. In 2017 Shanghai’s mainstream IC design industry was at 90nm ‒ 65nm ‒ 40nm level with some has reached 16/14nm level, meanwhile the 10nm design technology was under development. China's IC design enterprises have promoted into the world's first camp, and their international competitiveness has improved significantly.

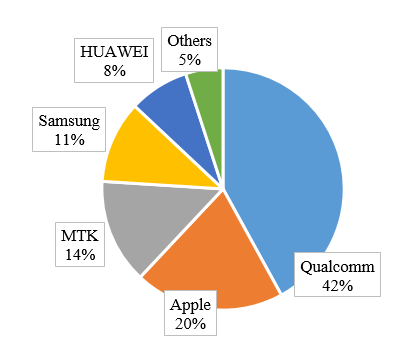

There are many segments of the integrated circuit industry. In details, application-specific integrated circuit has increased largely and mainly attributes to the consumer electronics, such as mobile phone chips, chip set-top boxes, security cameras chips. Except for a handful of specific areas occupying the high end market, for example, Huawei HiSilicon 400G core router autonomous chip was launched ahead of its competitor Cisco in 2013, and HiSilicon high-end mobile phone application processor chip lead the application of advanced 10nm node process, others are mostly focused at the low-end level. Spreadtrum’s 2016 chip delivery accounted for 42% of the world's low-end market, accounting for 37% of global revenue and entered the top three smartphone chip manufacturers, and exhibited significant advantage in the low-end smart phone chip market. In eight areas of communication, smart card, computer, multimedia, navigation, simulation, power and consumer electronics, the communications chip design accounted for 50% of the market volume due its large growth and huge market capacity, while other areas of the industry are relatively small.

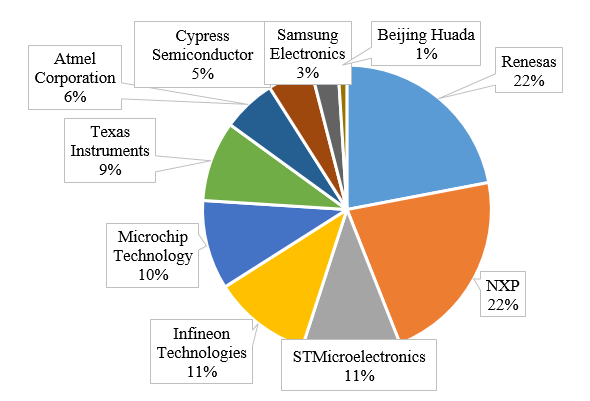

Regarding to the high-end general-purpose chip design, there is still big gap between China and overseas, and China is still highly dependent on external supplies. Among China's IC imports of more than 200 billion US dollars a year, the two types of high-end general-purpose processors and memory chips together accounted for more than 70%. Loongson has developed fast in recent years, however it was only limited in the military applications, and was still far from the civilian use. Three major memory projects have just launched, and regarding to the FPGA and other high-end general-purpose chips, domestic supply remains blank.